Blog

Best Stripe alternatives for digital sellers

Learn when to use payment processors, delivery platforms, or merchant of record solutions for your products.

Stripe is excellent at what it does. It processes payments reliably, offers APIs, and charges fees for the simplicity and reliability it delivers. For moving money online from your customers' wallets to your bank account, it has become a sort of default choice for online payments.

But if you're selling digital products, payment processing is just one piece of the puzzle.

Stripe handles the transaction.

It doesn't handle what happens after: delivering your files securely, protecting your products from unauthorized sharing, managing download limits, or navigating the increasingly complex world of international tax compliance.

Digital sellers face challenges that physical product sellers don't. When someone buys a t-shirt, you ship it once and the transaction is complete. When someone buys an ebook or a course, you need to deliver it instantly, prevent it from being shared across the internet, potentially stamp it with buyer information for traceability, and ensure the download link expires before it ends up on a file-sharing forum.

Then there's the tax question. If you sell digital products to customers in the EU, you're responsible for collecting and remitting VAT based on each customer's location, not yours. In the US, sales tax obligations vary by state, with different thresholds and rules for digital goods. Stripe now offers Stripe Tax to help with calculations, but you remain legally responsible for registration, filing, and remittance. The liability stays with you. Stripe Tax is not an MoR.

So when digital sellers search for "Stripe alternatives," they're often looking for something Stripe was never designed to provide. The real question isn't necessarily what replaces Stripe but rather "what goes alongside Stripe to handle everything else?"

Understanding your options

Before comparing specific platforms, it helps to understand the three distinct categories of solutions available. Each takes a fundamentally different approach to solving the digital seller's challenges.

What are payment processors?

Payment processors handle transactions. They move money from your customer to you, manage fraud detection, and provide the checkout infrastructure. Stripe, PayPal, and Square all fall into this category.

What they don't do is deliver your digital products, protect your files, or take responsibility for tax compliance. When you use a payment processor alone, you're responsible for building or buying everything else: the delivery system, the security measures, the tax calculations, and the compliance filings.

For digital sellers, payment processors are a necessary foundation but not a complete solution.

What are digital delivery platforms?

Digital delivery platforms work alongside your existing payment processor. You keep your Stripe or PayPal account, maintain your direct relationship with the payment provider, and pay their standard processing fees. The delivery platform adds what's missing: secure file hosting, automated delivery, download protection, and often tax compliance features.

This approach gives you the best of both worlds. You get Stripe's low processing fees and reliable infrastructure while adding the digital-specific features you need. The tradeoff is slightly more setup work since you're connecting two systems rather than using one all-in-one solution.

What are Merchant of Record platforms?

Merchant of Record platforms take a completely different approach. Instead of working alongside your payment processor, they replace it entirely. When a customer buys your product, they're technically buying from the MoR platform, which then pays you as a vendor.

This structure shifts significant responsibility off your shoulders. The MoR handles payment processing, tax collection, tax remittance, and compliance filings. They're the legal seller, so they carry the liability. You receive payouts after they've handled everything.

The tradeoff is cost. MoR platforms typically charge 4% to 10% on top of payment processing fees. You also give up some control over your customer relationships and payment data. For many sellers, especially those selling internationally, this tradeoff makes sense. For others, the fees eat too deeply into margins.

Payment processor alternatives to Stripe

If you're specifically looking to replace Stripe as your payment processor while handling delivery and compliance separately, a few options stand out.

PayPal

PayPal remains one of the most recognized payment methods globally. Many customers trust it implicitly and prefer it over entering card details directly. In some European markets, PayPal is the dominant payment method.

For digital sellers, PayPal works well as a secondary payment option alongside Stripe. Offering both gives customers flexibility and can reduce cart abandonment from buyers who prefer one over the other. SendOwl and most other delivery platforms integrate with both, so you can offer multiple payment methods through a single checkout.

PayPal's fees are comparable to Stripe for most transactions, though the fee structure varies by transaction type and volume. The main limitation is that PayPal alone doesn't solve the delivery or tax compliance challenges any more than Stripe does.

Square

Square built its reputation on in-person payments but has expanded significantly into online commerce. If you sell both physical and digital products, or if you sell at events and markets alongside your online store, Square's unified ecosystem has appeal.

Square offers an integrated online store option, which simplifies setup for sellers who don't already have a website. The fees are competitive with Stripe, and the platform is notably easier to use for non-technical sellers.

The limitation for digital-focused sellers is that Square's strength lies in physical retail. Its digital product features are less developed than specialized platforms. If digital products are your primary business, you'll likely need additional tools.

Square is also generally US-centric, focused on retail and physical goods, and not particularly involved in providing any DRM for digital goods.

Digital delivery platforms

This category offers a distinctive approach: keep your existing payment relationships and add a specialized layer for digital product needs.

SendOwl

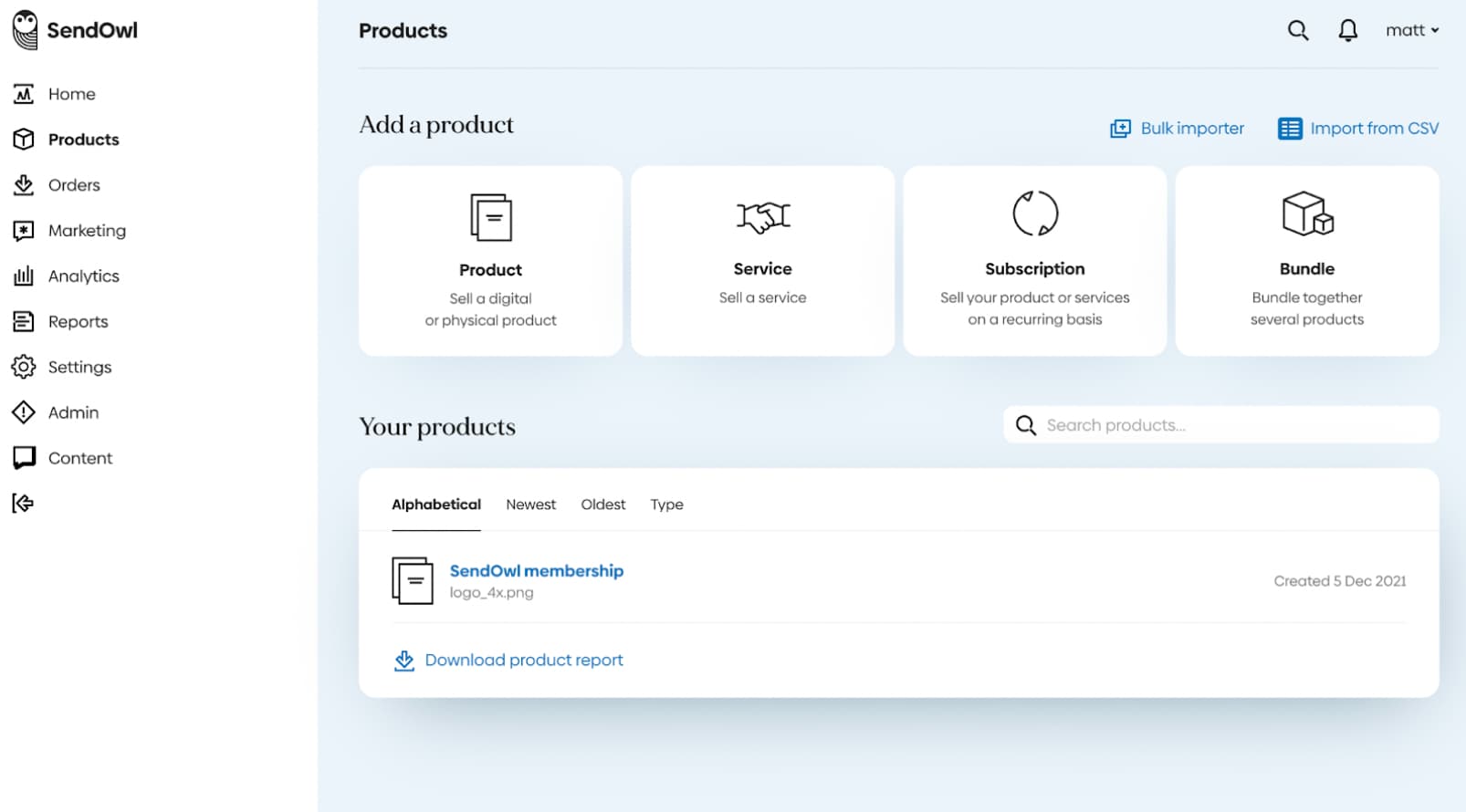

SendOwl connects to your Stripe and PayPal accounts, handling everything that happens after the payment clears. When a customer completes checkout, SendOwl automatically delivers their purchase through secure, expiring download links.

The platform addresses the core challenges digital sellers face. PDF stamping embeds buyer information into documents, discouraging unauthorized sharing by making files traceable. Download limits let you control how many times a customer can access their files. Expiring links prevent old purchase links from being shared indefinitely.

For international sellers, SendOwl helps you handle EU VAT compliance, calculating the correct rate based on customer location and managing the complexity that trips up many digital sellers. You can also offer multiple payment methods through a single checkout, letting customers choose between Stripe, PayPal, or options like Klarna and Apple Pay.

The integration approach means you keep Stripe's competitive processing fees rather than paying the higher rates MoR platforms charge. Your customer relationships remain direct. You maintain access to your payment data. The platform simply adds the digital-specific infrastructure you need.

SendOwl integrates with WordPress, Shopify, and most major website platforms through embeddable buttons and checkout links. Setup is straightforward: create your products in SendOwl, upload your files, connect your payment gateways, and embed buy buttons on your site.

This approach works best for sellers who want maximum control and minimum fees while still getting robust digital delivery features. The tradeoff is that you're managing two connected systems rather than one all-in-one platform.

Merchant of Record platforms

If you prefer having a single platform handle everything, including taking on the legal and tax liability of your sales, the MoR category offers several options at different price points and with different strengths.

Gumroad

Gumroad pioneered the simple digital product sale and remains popular for its ease of use. You can go from zero to selling in minutes without technical knowledge. The platform includes a discovery marketplace called Gumroad Discover, which can drive organic traffic to your products. As of January 2025, Gumroad operates as a full Merchant of Record, handling all global tax compliance automatically.

The simplicity comes at a cost. Gumroad charges 10% plus $0.50 per transaction on top of payment processing fees. For a $20 product, you're paying roughly $2.50 to $3 in combined fees. That's significantly higher than Stripe's approximately $0.88 on the same transaction. Sales through the Gumroad Discover marketplace incur a 30% fee.

Gumroad works well for creators who prioritize simplicity above all else, who value the discovery marketplace exposure, or who sell lower volumes where the percentage fee matters less in absolute terms.

Lemon Squeezy

Lemon Squeezy emerged as a developer-friendly alternative to Gumroad with lower fees: 5% plus $0.50 per transaction. The platform offers strong features for software sellers, including automatic license key generation and delivery.

The interface is clean and modern, the API is well-documented, and the checkout experience is polished. Lemon Squeezy handles global tax compliance as part of its MoR service, which is a significant benefit for international sellers.

Additional fees apply in certain scenarios: 1.5% for international transactions outside the US, 1.5% for PayPal payments, 0.5% for subscription payments, 5% on revenue recovered through abandoned cart emails, and 3% on affiliate-referred orders.

One important note: Stripe acquired Lemon Squeezy in mid-2024. The platform continues to operate independently for now, but some sellers have expressed concern about long-term independence and potential changes under Stripe's ownership. It's worth considering whether platform independence matters to your business.

Polar

Polar takes an open-source approach to the MoR model. Built by developers for developers, the platform is fully transparent with its codebase available on GitHub under an Apache 2.0 license.

At 4% plus $0.40 per transaction, Polar positions itself as the cheapest MoR option on the market, noting they cover Stripe's underlying 2.9% + $0.30 fee within their rate. The platform offers features specifically valuable to software sellers: GitHub repository access automation, Discord role management, license key delivery, and file downloads up to 10GB.

Polar raised $10 million in seed funding in June 2025 and serves over 18,000 customers across more than 100 countries. The platform is newer than some competitors but has gained traction quickly in the indie developer community.

For sellers who value open-source principles, want the lowest MoR fees available, or need tight integration with developer tools like GitHub and Discord, Polar is worth serious consideration.

Creem

Creem positions itself as the financial operating system for AI-native startups and modern distributed teams. The platform charges 3.9% plus $0.40 per transaction with no additional fees for international cards or subscription payments.

Beyond standard MoR features, Creem offers revenue splitting functionality that lets you automatically divide income among team members, partners, or collaborators. This is particularly valuable for distributed teams building products together.

The platform includes an AI assistant that analyzes your sales data and surfaces insights about customer behavior and revenue trends. License key management, file delivery, and subscription handling are all built in.

Creem is young, having launched in 2024, and raised €1.8 million in pre-seed funding in August 2025. It's gaining traction with AI startups and lean SaaS teams who value fast setup and modern tooling.

Payhip

Payhip offers a free tier with 5% transaction fees, a Plus plan at $29/month that reduces fees to 2%, or a Pro plan at $99/month that eliminates platform fees entirely. This structure makes it accessible for new sellers while offering a path to lower fees as revenue grows.

The platform is particularly strong for course creators and membership sites. You can build curriculum, manage members, set up multiple pricing tiers, and handle ongoing subscriptions. Payhip also supports physical products, making it versatile for sellers with diverse catalogs.

The interface is beginner-friendly, designed for creators who may not have technical backgrounds. Built-in affiliate marketing tools help you recruit others to promote your products. Payhip handles EU VAT and UK tax collection and remittance automatically.

For course creators, coaches, or membership-based businesses, Payhip's feature set aligns well with those specific needs.

Paddle

Paddle targets established software companies with significant revenue. The platform offers sophisticated subscription management including seat-based pricing, usage billing, proration, dunning management, and complex upgrade/downgrade flows.

Fees are higher than other MoR options and are typically negotiated based on volume. Paddle's strength is handling enterprise-level complexity that simpler platforms can't match.

The platform is particularly popular with EU-based SaaS companies who rely on its comprehensive VAT automation. Paddle's analytics and reporting tools are robust, providing detailed insights into subscription metrics, churn, and revenue trends.

For software companies with complex billing needs, significant revenue, and the resources to justify higher fees, Paddle offers capabilities that justify the cost.

FastSpring

FastSpring is a full e-commerce platform for software vendors, offering not just payment processing and MoR services but complete storefront functionality, product bundling, and licensing tools.

The platform is designed for software businesses that want a fully managed e-commerce experience. You can create branded product pages, handle complex product configurations, and manage everything from a single dashboard.

FastSpring is enterprise-focused with pricing to match. It's best suited for established software companies with diverse product lines and the need for comprehensive e-commerce infrastructure.

How to choose the right approach

The right choice depends on your specific situation, priorities, and constraints.

When to stick with Stripe plus a delivery layer

The Stripe-plus-companion approach makes sense when you want to minimize transaction costs. Payment processing fees alone are lower than MoR platform fees. Over time, especially at higher volumes, this difference becomes significant.

This approach also works well when you value owning your customer relationships directly. Your customers pay you, not a third party. You have full access to payment data, customer information, and transaction history.

If you're comfortable with some initial setup work and already have a website or platform where you'll sell, connecting Stripe with a delivery platform like SendOwl is straightforward. You get the specific features you need without paying for infrastructure you don't use.

Finally, if you want to offer multiple payment methods, Stripe plus PayPal through a delivery platform gives customers options while keeping your setup streamlined.

When to choose a Merchant of Record

The MoR approach makes sense when you want zero responsibility for tax compliance. International tax obligations are complex and the penalties for mistakes are real. If the idea of registering for VAT, filing returns, and staying current on changing regulations sounds overwhelming, paying higher fees to make it someone else's problem is a reasonable choice.

MoR platforms also excel when speed to market matters more than cost optimization. You can go from idea to selling in minutes with platforms like Gumroad or Lemon Squeezy. If you're testing a new product idea and don't want to spend time on infrastructure, this speed has value.

For sellers just starting out with low volumes, the percentage-based fees matter less in absolute terms. Paying 10% of a $500 month is $50. That's real money, but it may be worth it for the simplicity. As volumes grow, the math changes and it becomes worth reconsidering.

Making the switch

If you're moving from one platform to another, a few considerations will smooth the transition.

First, check how existing customers will be affected. If you have active subscriptions, understand how to migrate them without disrupting recurring revenue. Some platforms offer migration tools; others require manual recreation.

Second, consider your existing download links. Customers who purchased previously may still have links to their products. Ensure those links continue working or communicate the change clearly.

Third, test thoroughly before going live. Process test transactions, verify delivery works correctly, and confirm tax calculations match your expectations. A few hours of testing prevents customer-facing problems.

Finally, update your embedded buttons, checkout links, and any automated workflows that reference your old platform. A checklist of everywhere your checkout appears helps ensure nothing gets missed.

Helping people sell digital goods in a better way

community

Join our newsletter for the latest tips, updates,

and exclusive offers to supercharge your digital product sales.